haven't done my taxes in 3 years canada

I am a complete idiot and have not filed my tax returns for the past 3 years. Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more.

What If I Can T Pay My Taxes In Canada Loans Canada

There could be many reasons why a person wouldnt have paid their taxes for several years.

. If you havent filed your corporate registry documents in the last three years your company is in. No matter how long its been get started. Not filing a tax return on time is one of the most common tax problems.

If you have any questions about the above information please dont hesitate to call me at 250-381-2400 and I would be glad to help you through the process. All sorts of people put off filing their tax returns and thats a serious problem says Simpson. I worked for myself for about 3 years in the last decade not the most recent years.

You can only buy the last 3 years so currently 2016-2018 and 2019. Theres that failure to file and failure. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Self-employed workers have until June 15 2018 to file their tax return. A late-filing penalty applies when you failed to file your taxes on time in any of the previous 3 years. Start with the 2018 one and then go back to 2009 and work your way back.

You could owe a lot of money and not be able to afford to repay it you might have forgotten to pay. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. Get all your T-slips and what ever.

The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax. If you go to genutax httpsgenutaxca you can file previous years tax returns. The BC corporate registry is separate from the Canada Revenue Agency.

If you fail to file on time again within a three-year period that penalty goes up to 10 of unpaid taxes plus 2 per month for a maximum of 20 months. I assume the CRA has not contacted me because my income would have been too low to owe anything- except a. Section 239 of the Income Tax.

What Happens If You HavenT Filed Taxes In 3 Years Canada. Individuals who owe taxes for 2017 have to pay by april 30 2018. I havent filed taxes in.

What Happens If You HavenT Filed Taxes In 3 Years Canada. Sometimes they havent filed for 10 years or more. If you have unfiled tax.

Failure to file your tax return by June 15 2010 after three previous years would result in a penalty of 10 of your balance owing plus 2 interest per late month until you pay. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. The IRS estimates that 10 million people fail to file their taxes in any given year.

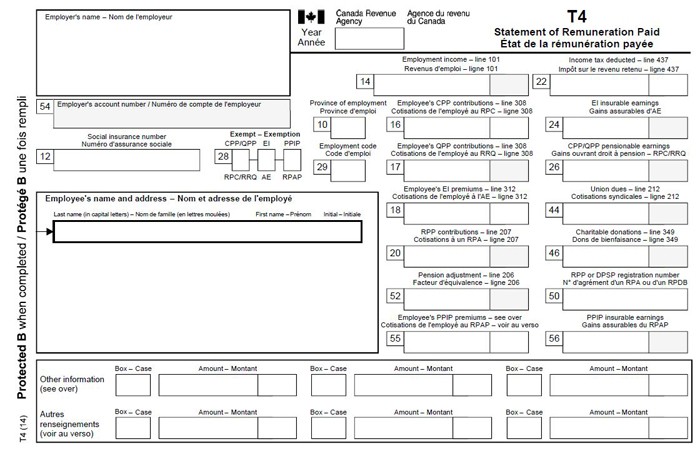

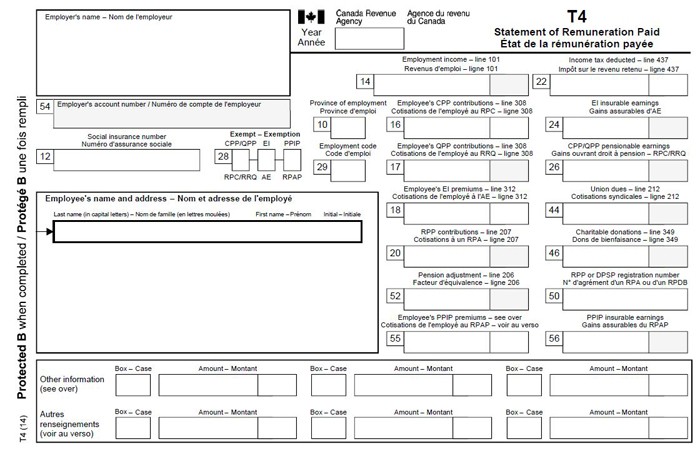

Youll need to engage a competent professional to properly review and assess your situation before fully understanding your tax requirements. They will want to verify who you are so. Next go to your nearest CRA office and request tax forms for the years for which you need to do your taxes.

According to the cra a taxpayer has 10 years from the end of a calendar year to file an income tax return. Most Canadian income tax and benefit returns must be filed no later than April 30 2018. Haven T Filed My Taxes In 6 Years Canada Ictsd Org You may also face late filing penalties.

Yes the IRS will work with you on this but first youve got some work of your own to do. Answer 1 of 24. You should do your tax returns for the past 6 years.

Have you been contacted by or acted upon Canada. The first step in getting out of your tax mess is calling the IRS. Id go to a professional group like HR Block.

I havent done my Canadian taxes in six years what should I do.

When Is Too Late To File A Canadian Tax Return

Haven T Filed My Taxes In 3 Years Canada Ictsd Org

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How To File Overdue Taxes Moneysense

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Pin By K B On Arbonne Stuff Business Opportunities Quotes Opportunity Quotes Rodan And Fields Consultant

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

Compact Travel Stroller Fits In The Overhead Compartment Of An Airplane Best Lightweight Stroller Baby Strollers Yoyo

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Forever Is Composed Of Nows Emily Dickinson Its Almost Time Tomorrow Afternoon October Pre Ord Illustration Custom Portraits Commission Portrait

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Murdoch Mysteries The Curse Of The Lost Pharaohs Tv Series 2011 Imdb Murdoch Mysteries Mystery Movie Tv

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Tax Tips For Self Employed Professionals Freelancers And Contractors Tax Return Filing Taxes Bookkeeping Services

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates