change in net working capital dcf

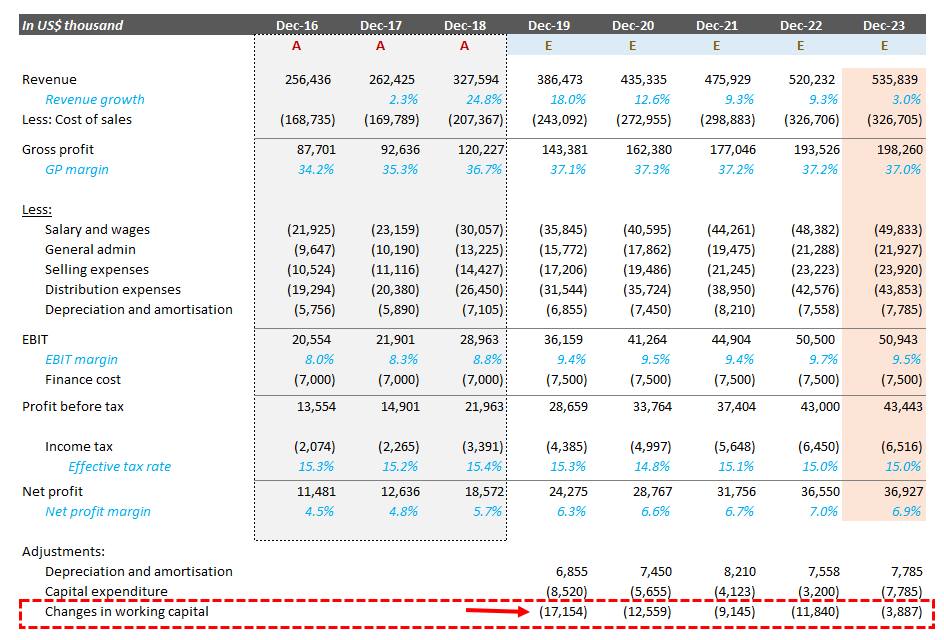

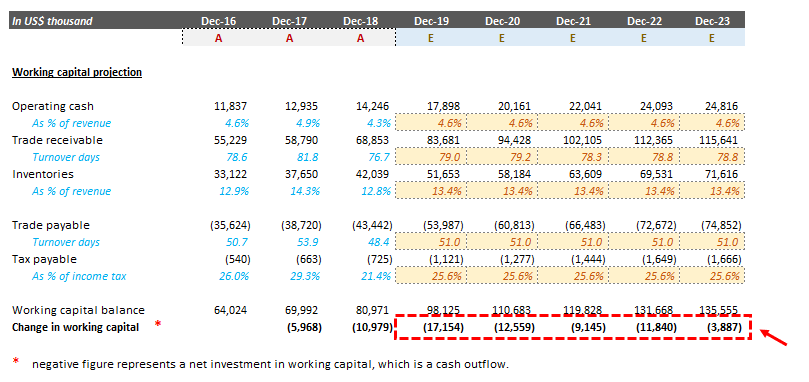

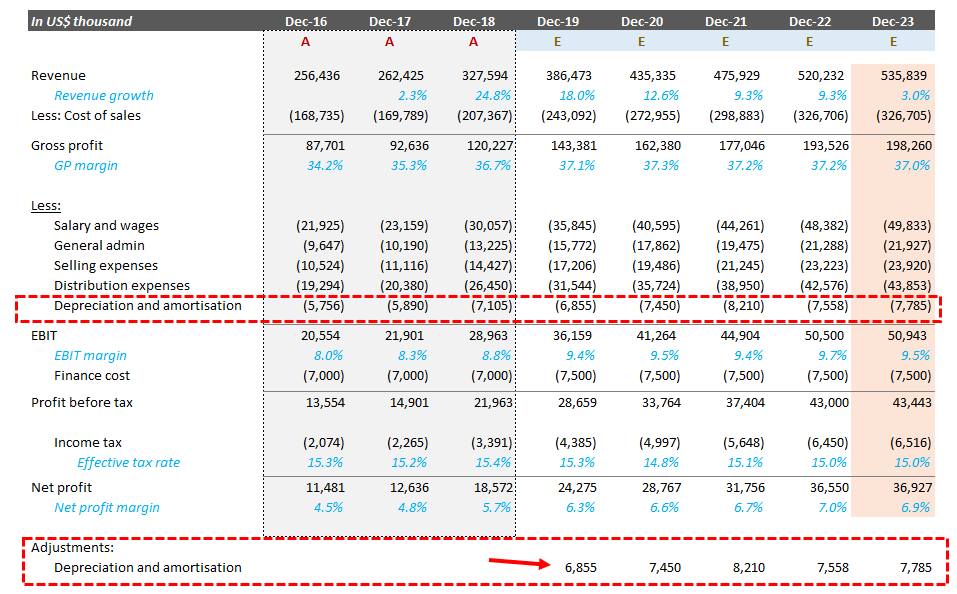

In this video I cover the different ratios tha. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year.

Change In Net Working Capital Nwc Formula And Calculator

You have to think and link what happens to cash flow when an asset or liability increases.

. This suggests the need to scrutinize the balance sheet. Stocks that trade below their fair value and therefore they have room for growth. Change In Working Capital explanation calculation historical data and more.

Change In Working Capital as of today May 29 2022 is 000 Mil. It still counts as cash that is tied into running the day to day operations of the business. You arent projecting flat revenue going forward.

The non-cash working capital for the Gap in January 2001 can be estimated. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. Changes in working capital are reflected in a firms cash flow statement.

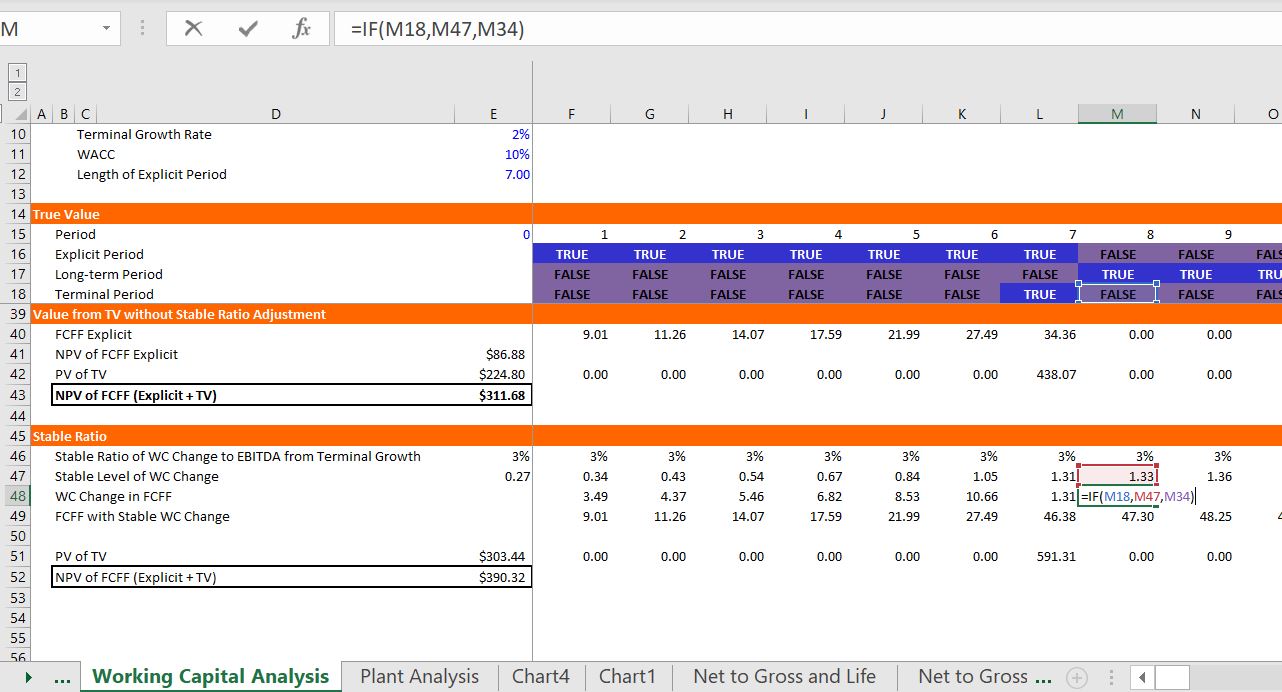

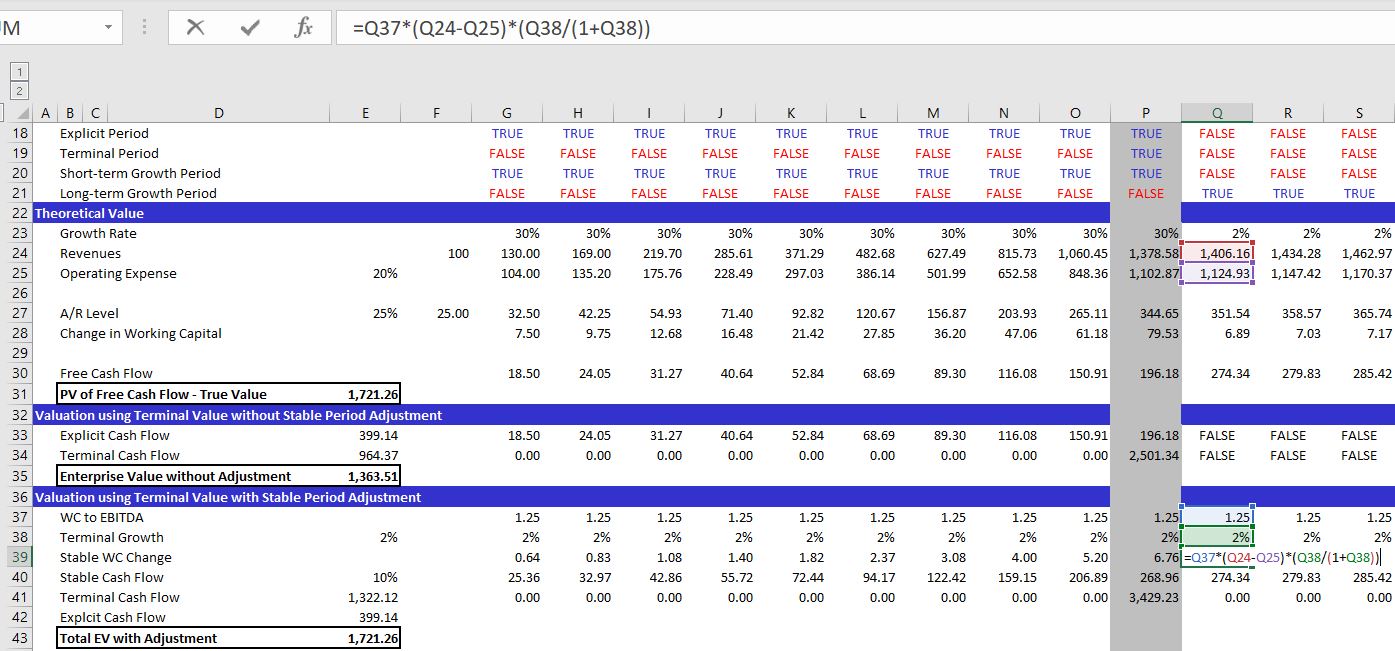

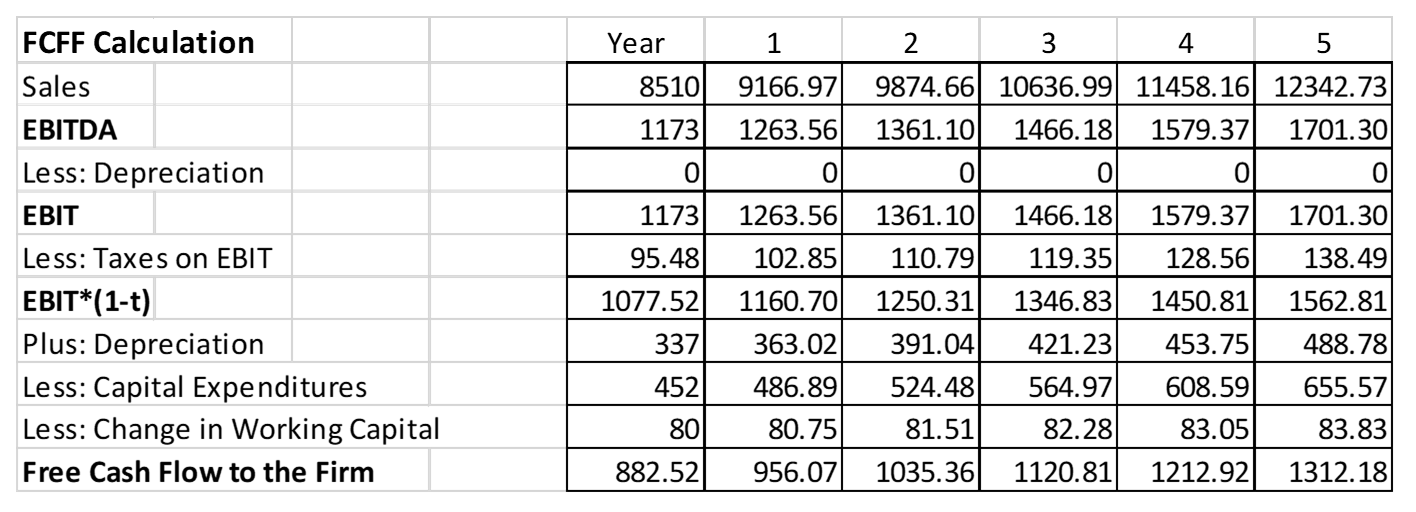

In the DCF method change in working capital would exclude change in cash cash equivalents and current financial debt and include non financial items such as change in inventories receivables payables. AVD Change In Working Capital as of today April 21 2022 is 367 Mil. Stable WC Change WCEBITDA EBITDA t terminal growth 1terminal growth.

In FY2015 changes in assets and liabilities subtracted 827M from operating cash flow in FY2016 it added 153M and in. So a positive change in net working capital is cash outflow. The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures.

Below is Northrops cash flow from operations over the past three years. The operating side of assets may be viewed as requiring the use of cash and includes. Working Capital The Gap.

The DCF calculation would give you Enterprise Value to which you would then in order to get Equity value. The change in future revenue would require a change in net working capital. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash.

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets. Non-cash working capital 1904 335 - 1067 - 702 470 million. The formula for the change in net working capital NWC subtracts the current period NWC balance from the prior period NWC balance.

The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital. You include change in cash as a part of change in overall working capital. Cash on hand varies for different companies but having.

Change in Working Capital is a cash flow item and it is always better and easier to use the numbers from the cash flow statement as I showed above in the screenshot. Change in Net Working Capital Working CapitalAssets-Liabilities When talking about working capital one has to zoom in on assets and liabilities. The change refers to how the cash flow has changed based on the working capital changes.

In depth view into. See my other WSO blog posts. How to Calculate a DCF The goal of a DCF valuation is to derive the fair value of the stock and determine whether it trades above this value overvalued or below this value undervalued.

Similarly change in net working capital helps us to understand the cash flow position of the company. Aug 16 2013 -. The implications of this assumption in a long-term forecast must be carefully analyzed.

When you are building a dcf. Change in NWC Formula Change in Net Working Capital NWC Prior Period NWC Current Period NWC. Remember that value investing is set out to find undervalued stocks ie.

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow.

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Dcf Model Tutorial With Free Excel Business Valuation Net

Change In Working Capital Video Tutorial W Excel Download

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Analysis Street Of Walls

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

The Acquisition Of Anadarko By Chevron Discounted Cash Flow Analysis Grin

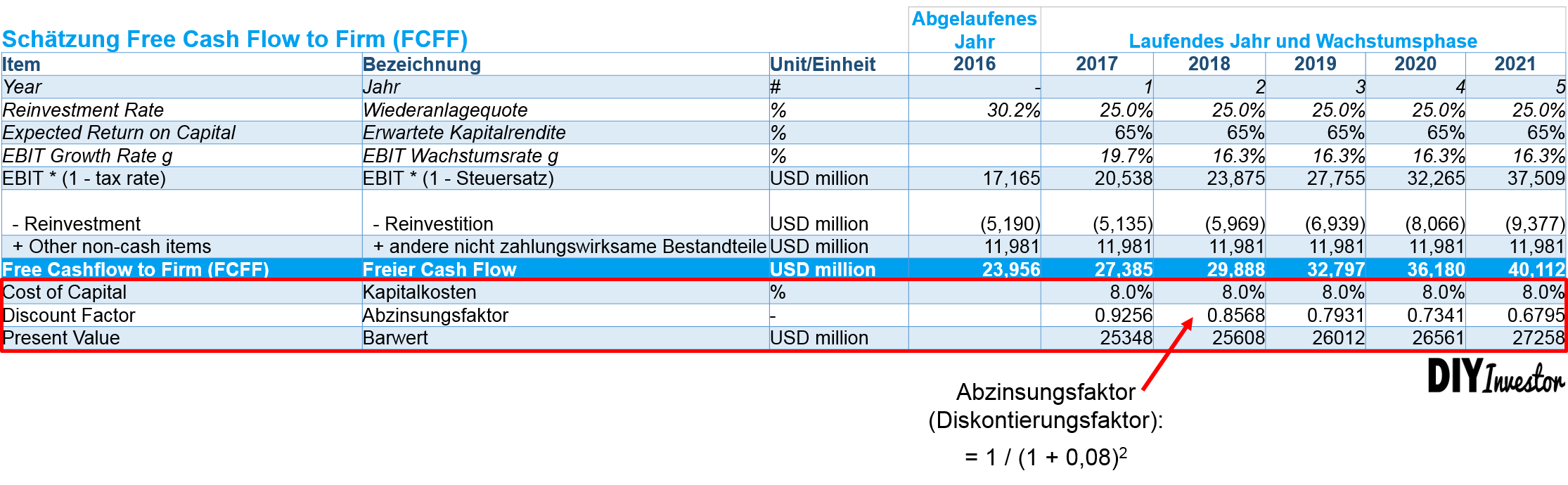

Dcf Bewertung In 6 Schritten Beispiel Microsoft Diy Investor

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Explaining The Dcf Valuation Model With A Simple Example

Dcf Model Tutorial With Free Excel Business Valuation Net

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)